Prior to 1978, China maintained a centrally planned economy. It was poor, stagnant, inefficient and isolated, mainly because the central government planned and managed most aspects of the economy and there was no free market at all. At the end of 1978, Deng Xiaoping, the Chinese top leader at that time, decided to make a breakthrough to decentralize the economy. From 1979, China has been implementing economic reforms by introducing free market principles and opening up to international trade and foreign investment. Those reforms were considered a breakthrough, because it actually introduced capitalist ideas to a socialist country. The economic reforms were said to develop “socialism with Chinese characteristics,” indicating that the Chinese market economy served as a tool of the Communist Party.

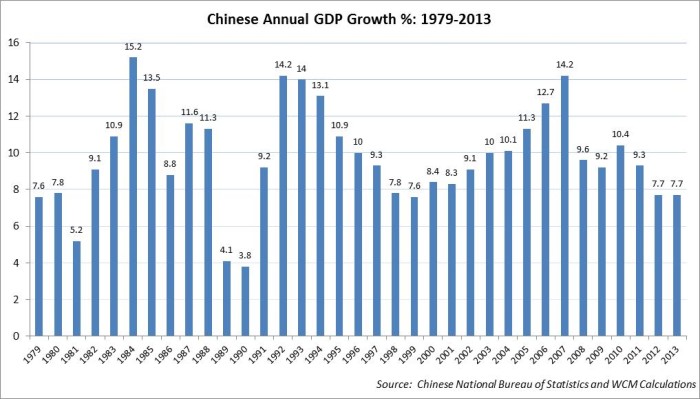

Over the following three decades, the economic reforms have proved to work well. China’s Gross Domestic Product (GDP) grew at an average annual rate of nearly 10% during this period. However, the explosive growth seems to have run out of steam recently. China’s GDP grew 7.7% both in 2012 and 2013 (year on year) and grew 7.4% (quarter on quarter) in the first quarter of 2014 .China is the world’s second largest economy and an important engine of global economic growth. A slowdown in China goes beyond being a domestic issue and has influence on the global economy. China’s next step draws the attention of the whole world.

Let’s first look at what caused China’s rapid economic growth for more than 30 years. The relatively free market encouraged competition and better resource allocation, which promoted efficiency and productivity. Access to foreign investment and trade helped China fully utilize its relative advantage—extensive low-cost labor. The manufacturing industry has created more jobs and exports, contributed to economic growth, and further attracted more investment. China has become the world’s largest manufacturer and merchandise exporter. However, as wages in China have risen in recent years, the low labor cost advantage has been eroding. The export and investment-led growth model is an early stage development model and seems to have already reached its limit. That is why China is trying to convert its economy to being consumption-driven with more sustainable and balanced growth. In addition, the incomplete transition to market economy, i.e. the government intervention to the economy has caused problems and hindered further growth.

China has successfully decentralized its economy, but the transition to a market economy is not complete due to its political system that still remains centralized by one party. To consolidate its ruling over the country, the Chinese central government controls important sectors, such as telecommunications, petroleum, utilities and transportation. State-Owned Enterprises (SOEs) dominate those sectors exclusively from competition, even though some of them are not profitable.

The central government also controls the banking system, setting deposit interest rates low to make state controlled commercial banks borrow money at a low rate. However, commercial banks have discriminatory lending policies to enterprises. SOEs often have cheap credit despite that they may not be able to repay the loans, while private companies are required to pay higher rates or cannot get loans from commercial banks. That is why many private companies have turned to shadow banking and many people are worried that the rise in defaults in the showdown banking debt will cripple the Chinese economy.

The low-deposit interest rate also has a negative impact on personal income. The Chinese households put a large portion of their income into bank’s saving accounts due to the lack of a sound social security system and Chinese people’s habit of saving money for future big use. For example, young people save money to buy housing to get married, to prepare for kid’s education and to take care of old parents. The deposit interest rate is often lower than the inflation rate and thus forms a “tax” to reduce the disposable personal income. With less disposable income, Chinese are more afraid of future uncertainties and less willing to make current consumption.

The good news is that new leadership is more market-oriented and has the determination to overhaul the economy. In the Third Communist Party Plenum last November, the Party, under the leadership of President Xi Jinping, came up with a communique stating that the market would play a decisive role in allocating resources. The detailed plans included restructuring SOEs to reduce their role in the economy and increasing competition from private sectors; making credit accessible to productive businesses; interest rate liberalization; Enhancing exchange rate flexibility; greater openness to foreign investments; encouraging the expansion of service industries; reducing the personal income tax; and improving the pension system . The plans emphasized the goals of perfecting the market mechanism and increasing people’s well-being to create more consumption.

The implementation of the new round of economic reforms may encounter resistance. The SOEs, local governments and other invested interest groups who benefit from the status quo are threatened by change. They may try to delay the implementation to further enjoy their priorities. Besides, the successful economic restructure might compromise short-term growth. A continued economic slowdown in China would keep pulling down the economy of its trading partners, considering China’s important role in the international trade market. Also, bad loans could increase as China has been over-reliant on investment and this would increase the risk of a credit crisis. However, the Chinese government has already decided to sacrifice the short term GDP growth for long term good. The 2014 target GDP growth has been set to 7.5% to help China advance the economic reforms.

In the long run, the successful reforms would lead to a more balanced and healthy economy. A deepening development of a market mechanism would make china a more efficient world player. A transition from an export-led economy to a consumption-driven one would focus more on people’s living standard instead of the GDP headline growth. The extensive Chinese population has strong potential buying power. The increasing domestic demand would make China a giant market for emerging economies and help China reduce its large scale foreign currency reserve. The less focus on the manufacturing industry would alleviate the environmental pollution issue and further contribute to slow down the global greenhouse effect. The expansion of the service sector would create more jobs and stimulate technology innovation. “Innovative in China” would be more competitive than “Made in China” and reduce the reliance on foreign technology innovation.

Reforms are not made overnight. Deng Xiaoping’s reform in 1978 took 30 years to make a poor and isolated China become a global major economic power. Now the new economic reform plan is considered the most ambitious one since 1978. Even though it might take years to finish the economic restructuring, the new Chinese economy would definitely bring more steady and sustainable growth to the world and play a more significant role in the global economy. China is presenting a good investment opportunity as Chinese stock valuations, relative to other international stock valuations, hover near their lowest level in a decade. We will continue to monitor the reforms and valuation levels of Chinese stocks to gain from this opportunity within our strategies that have exposure to emerging market equities.

Daisy (Xiaoyu) Ma

Analyst

Sources:

1) Chinese National Bureau of Statistics

2) Chinese National Bureau of Statistics

3) http://serviciodeestudios.bbva.com/KETD/fbin/mult/140214_China_Outlook_Q1_EN_tcm348-426021.pdf?ts=532014

Disclosure: Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.