- If the next quarter GDP report is below 1.8%, we will be in that high-risk area for a recession.

- The median gain for the stock market during the second half of a presidential election year hs been 6%.

- The nonpartisan Congressional Budget Office estimates that the fiscal cliff would result in a projected decline in GDP of -1.9% during the first half of 2013.

As we move into the 4th quarter of the year, we are finally drawing near the end of a long Presidential Election campaign. While the election is grabbing most of the headlines, there are some other very important factors that are going to have a significant impact on the financial markets over the next year or two, and I felt it would be important to briefly discuss them.

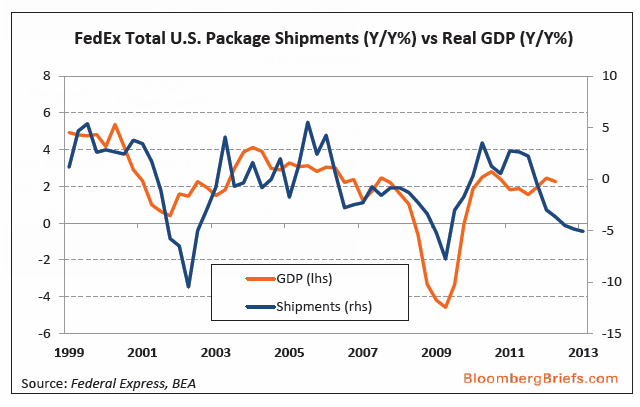

We have discussed the challenges to the economy several times this year as we have seen continued slowing both domestically and abroad. There are many different ways to measure the slowdown in the economy, and as we discussed in our online commentary from last month, I feel that a graph showing the growth or decline in shipments by FedEx compared to economic growth could summarize the problem. As shown in the graph below; FedEx shipments have dropped to levels that we have historically only seen during recessions.

In addition, our prior quarterly commentary talked about the concept of “stall speed” for the economy. Historically speaking, when economic growth as measured by GDP drops below a 2% annualized rate over the past two quarters, the probability of recession is 48% within the next year. If the four rolling quarter rate of GDP drops below 2% the probability of a recession during the next year jumps up to 70%. With the most recently revised report of GDP coming in at an annualized rate of 1.3%, the two quarter annualized GDP is at 1.65%, and the 4 quarter GDP growth rate is at 2.03%. If the next quarter GDP report is below 1.8%, we will be in that high-risk area for a recession.

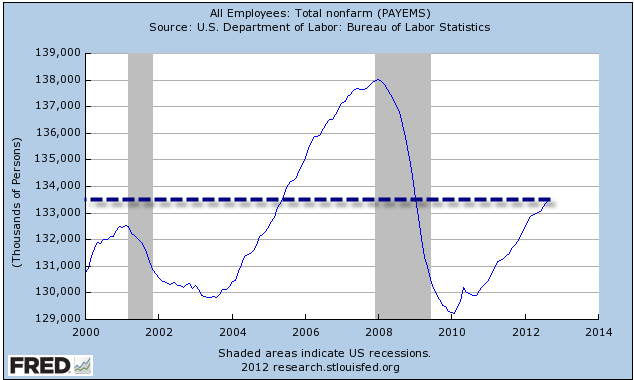

The Federal Reserve is obviously closely watching the economy and looking for ways to meet their dual mandate of price stability and full employment. While price stability has been reasonably easy to maintain over the past few years, fostering the conditions for full employment has been a tremendous challenge. As the graph below shows, we are still a long ways from recovering all of the jobs that were lost in the last recession, and are just now getting back to the number of jobs that we had in 2005.

In response to the renewed slowdown in economic growth the Federal Reserve announced a new round of quantitive easing on September 13th in which they will purchase $40 billion per month of mortgage-backed securities until there is substantial improvement in the labor market outlook. This action is being taken as Central Banks in Europe and Asia are implementing similar measures.

This move is designed to continue to push interest rates lower on mortgages and pump money into the banking system with the hope that it eventually finds its way into the economy. It appears that the primary goals for the program are to continue to support the housing market, which is beginning to show signs of sustained improvement in an increasing number of areas throughout the country, and to provide ongoing economic stimulus until the labor market improves. The goal is sound, but the risk of the additional money being pumped into the economy does increase our concern about inflationary problems down the road.

In regard to the Presidential election, historically speaking, the stock market typically does advance during the second half of a Presidential election year as markets are able to get past the uncertainty of who will be in control of the Presidency, and they can deal with the known policies and proposals that will be the focus over the next four years. The median gain for the stock market during the second half of a presidential election year has been 6%. However, remember that two of the last three election years, 2000 and 2008 did see significant stock market declines, so it is important to remember that while the historical tendencies are nice, the current market environment is more important.

It is quite likely that the most important event once we get the election behind us is the impending “fiscal cliff” which is the popular shorthand term used to describe the conundrum that the U.S. government will face at the end of 2012, when the terms of the Budget Control Act of 2011 are scheduled to go into effect.

Among the laws set to change at midnight on December 31, 2012, are the end of last year’s temporary payroll tax cuts (resulting in a 2% tax increase for workers), the end of certain tax breaks for businesses, shifts in the alternative minimum tax that would take a larger bite, the end of the “Bush” tax cuts from 2001-2003, and the beginning of taxes related to President Obama’s health care law. At the same time, the spending cuts agreed upon as part of the debt ceiling deal of 2011 will begin to go into effect. According to Barron’s, over 1,000 government programs – including the defense budget and Medicare are in line for “deep, automatic cuts. In its recent analysis of the impact of these changes, the nonpartisan Congressional Budget Office (CBO) estimates that these changes will provide $487 Billion1 in additional revenue to the government in 2012.

While this would help to reduce the budget deficit, it would also result in a projected decline in GDP2 of -1.9% during the first half of 2013 according to the CBO, before rebounding to post a full year contraction in GDP of -.5%. The positive side to this is that the projected long-term budget deficit to GDP would decline to 58.5% by 2022 vs. a projected debt/GDP ratio of 89.7% if most expiring tax provisions are extended indefinitely. The very negative side to all this is that if we have the full impact of the fiscal cliff hit us with our currently weak economy, the CBO expects that we will go into a recession in 2013 with all the attendant job losses, bankruptcies, etc. In addition, every recession we have been through has also come with significant declines to the stock market (average -27% according to Ned Davis Research) and volatility to the financial markets in general.

In summary, the financial markets are at an important juncture where the actions of politicians will have a significant impact of what path the stock market follows over the next year. If all goes well and we avoid a recession, we are likely to see a continued drift higher as low interest rates push more investors out of money market funds and government bonds into other income producing asset classes and stocks. If we do go off the fiscal cliff the downside for stocks is likely to be more than normal due to the reduced number of traditional tools that the Federal Reserve will have available to help stimulate the economy. We will be actively monitoring and making adjustments as needed.

Michael Ball

Lead Portfolio Manager

Sources: (1) http://cbo.gov/sites/default/files/cbofiles/attachments/08-22-2012-Update_to_Outlook.pdf (2) http://money.cnn.com/2012/08/22/news/economy/fiscal-cliff/index.html

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.