- Election “Markets”

- If the U.S.A. Were a Business

- A Functional Democracy

Last month’s commentary looked at economic indicators that may be useful in determining the likelihood of which party will win the presidential election this year. This month I would like to share some sources that can help you cut through the day-to-day soap opera aspect of politics and get one of the most accurate pictures of what the likely outcome of some of the most important races will be. In addition, I would like to share an excellent resource for those interested in looking at some un-biased data regarding several of the most pressing challenges that we face as a country and how we stack up against the rest of the world.

It does not seem all that long ago that I was breathing a sigh of relief that I was no longer being bombarded with campaign ads when I turned on the TV and yet, here we go again. I recognize that some people love the excitement and drama of politics, and just can’t get enough (they typically spend as much time watching CSPAN as farmers do watching The Weather Channel). For the rest of us interested in trying to determine the outcome of the elections with little effort, I would like to suggest keeping an eye on the prediction markets.

Prediction markets are websites where you can buy “shares” in an expected outcome for any number of events. The two most popular markets are INTRADE (www.intrade.com) and Iowa Electronic Markets (www.tippie.uiowa.edu/iem).

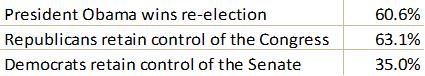

Each of these websites has “markets” for various events which a person can buy “shares” with real money, and invest in each event. Since these “shares” are bought and sold with real money, you are ultimately putting your money where your mouth is. As an example of how this works, let’s say that you feel quite strongly that the Democratic Party will retain the Presidency in the upcoming election. Currently, according to INTRADE, there is a 60.6%* chance of this event occurring and you can buy “shares” in this outcome for $6.06. If the Democrats win the presidency, that market will close out and each share will be worth $10, which equates to roughly a 65% return. If the Republicans win the Presidency, the value of the contract will be $0. These sites have contracts on events ranging from politics to international affairs, weather, and even who will win each Grammy category. The INTRADE website has an excellent link to a segment that was done on the ABC show, 20/20 during the last presidential election.

This illustrates the current probabilities for various political events.

If the U.S.A. were a business

In May of 2011, Businessweek Magazine ran an article entitled “USA Inc.: Red, White, and Very Blue.” In the article, Mary Meeker, a top ranked technology analyst, along with a group of colleagues and outside experts, put together a report that was designed to be both very extensive and un-biased. The objective was to analyze the United States as if it were a business. Within the scenario, each country’s citizens represented the shareholders. Each country was analyzed and compared, just as an analyst compares the fundamentals of companies. The analysis was designed to highlight how USA Inc. compares with Germany Inc., China Inc. etc. The article can be found at http://www.businessweek.com/magazine/content/11_10/b4218000828880.htm and the link to the accompanying 266 page PowerPoint presentation that digs into all of the data can be found there as well.

In May of 2011, Businessweek Magazine ran an article entitled “USA Inc.: Red, White, and Very Blue.” In the article, Mary Meeker, a top ranked technology analyst, along with a group of colleagues and outside experts, put together a report that was designed to be both very extensive and un-biased. The objective was to analyze the United States as if it were a business. Within the scenario, each country’s citizens represented the shareholders. Each country was analyzed and compared, just as an analyst compares the fundamentals of companies. The analysis was designed to highlight how USA Inc. compares with Germany Inc., China Inc. etc. The article can be found at and the link to the accompanying 266 page PowerPoint presentation that digs into all of the data can be found there as well.

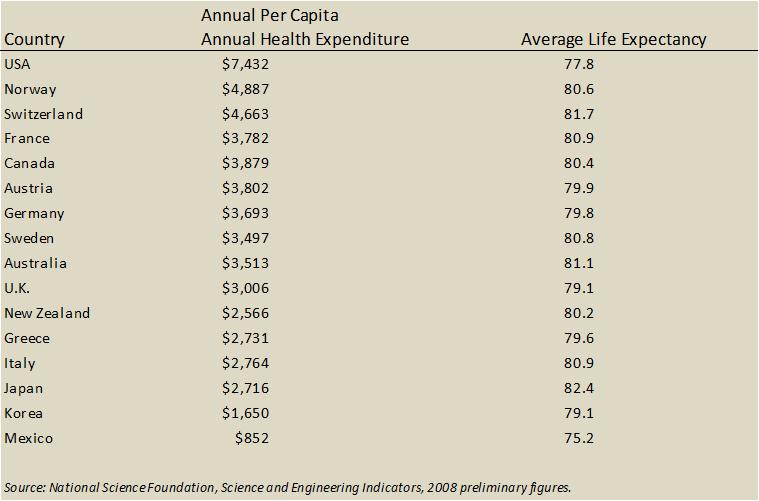

The article does an excellent job of cutting through much of the political rhetoric surrounding many important issues and provides solid comparisons from around the world. It provides a good benchmark to see how the U.S. as a country is performing. One example I found quite interesting, in light of the recent passage of the Health Care bill, was how we stack up versus the rest of the developed world in regard to health care cost and life expectancy. Here are the results:

The passage of the health care bill has been praised in its expansion of the number of people who will be covered by insurance, and there is some expectation of slowing healthcare costs in relation to the rest of the world. However, we are spending more than twice the average and still have below-average life expectancy rates.

Someone once said that political elections are much like spring training in baseball. Every team feels they have a lot of potential and promise, and then the real season begins. Unfortunately, it often seems to be much the same in politics with every candidate claiming that if they are elected that they or their party will be able to fix the problems that we face. However, in the past ten years we have seen each party, at different times, with full control of the Presidency, House of Representatives and Senate with little or no progress made on some of the most important issues that we and future generations face. In order for a democracy to function well, its citizens need to be informed and involved. It is my hope that this data will be useful in providing you with quality information and that you will be involved in solving the challenges that we face as a country.

Michael Ball

Lead Portfolio Manager

*As of 3/8/2012. Opinions expressed and information about Intrade are not meant to provide legal, tax, or other professional advice, nor as a solicitation or recommendation for investment, but are for reference purposes only. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Links to third party websites are provided for convenience only and Weatherstone Capital Management is not responsible for the contents. Intrade is not a recognized or designated investment exchange as defined by the Stock Exchange Act. Trading contracts on-line on the Intrade exchange involves risk. There is no guarantee or warranty whatsoever that if you trade any contract you will be able to liquidate or cover your position at any price let alone the price that you want. The IEM is an experimental market operated for academic research and teaching purposes. The IEM is not regulated by, nor are its operators registered with, the Commodity Futures Trading Commission or any other regulatory authority. Weatherstone Capital Management is providing the information from these websites on an “as is” basis. Studies relating to lifespan may be skewed depending on different countries calculation method. The information in the article is provided for information purposes only and WCM cannot accept any liability or responsibility in relation to such information. Weatherstone Capital Management is an SEC Registered Investment Advisor located in Denver, Colorado.